As we close the books on Q1-2025, the Pareto team is pleased to share an update on our continued momentum in building the institutional credit layer of DeFi. What began as a series of exploratory integrations has evolved into a robust product suite powering the next generation of onchain credit markets.

Q1 2025 Retrospective

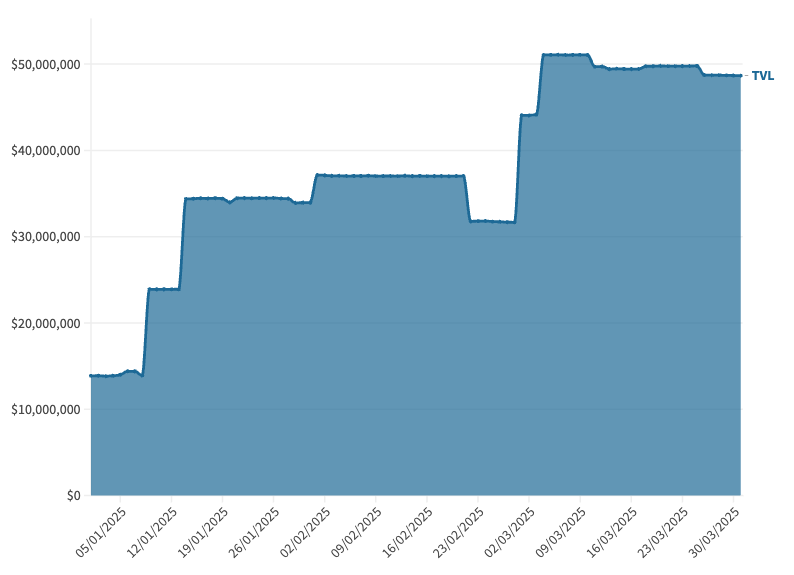

Q1-25 marked a pivotal inflection point for Pareto. Our Credit Vaults surpassed $50m in TVL, a testament to the growing institutional appetite for DeFi-native yield strategies backed by real credit flows. This growth comes despite broader macro headwinds, demonstrating that real-world utility and disciplined risk frameworks can attract capital even in less-than-ideal market conditions.

Behind the scenes, we’ve been in active conversations with a broadening set of institutional borrowers, from fintech lenders to structured credit desks, all seeking access to transparent, efficient, and programmable capital markets. This demand reinforces our thesis: the convergence of traditional credit underwriting with onchain settlement rails is inevitable, and Pareto is leading that transformation.

We’re also accelerating work on a new cornerstone of the ecosystem: a tokenized basket of credit lines designed to provide diversified exposure to institutional debt and serve as a synthetic dollar primitive within DeFi.

Q1 2025 KPIs

TVL for the quarter came in at an average of ~$37M, peaking at just over ~$51M – a clear indicator of sustained interest and capital inflows despite broader market uncertainty. Liquidity commitments across Credit Vaults remained stable, with all borrower-side obligations met. We’re also seeing strong forward momentum, with institutional demand and allocator interest building into Q2.

Protocol fees for the quarter totaled approximately $150k, primarily driven by the activation of new Credit Vaults and the expansion of the borrower base.

Source: Q1-2025 Pareto TVL | Flourish

Q1 Budget VS Actual

Budget utilization reached 142% of the forecast, largely due to critical investments in auditing the Credit Vaults (Sherlock) and engaging with a design agency for the upcoming website update.

Q2 2025 Goals

Looking ahead, we’re laser-focused on four core initiatives designed to accelerate Pareto’s growth and cement our position as a leading credit marketplace in DeFi:

- New Credit Vaults with Institutional Borrowers

Scaling our underwriting and onboarding pipeline to welcome a robust new cohort of institutional borrowers. These vetted counterparties are strategically selected across diverse geographic regions, ensuring an optimized balance of risk and return. By expanding our borrower base, we’re enhancing overall capital efficiency and dramatically widening the scope of opportunities available to allocators pursuing sustainable, real yields.

- Updated Pareto Website & Brand Rollout

In the coming weeks, we’ll unveil a fully redesigned Pareto landing page, meticulously crafted to reflect our evolved institutional positioning and sophisticated product architecture. This comprehensive update will also showcase Pareto’s refreshed branding, featuring clearer, more compelling messaging and a streamlined, intuitive user experience. Allocators, borrowers, and ecosystem partners will benefit from an improved interface, smoother navigation, and better access to essential resources.

- Tokenized Basket of Credit Lines

We are introducing a new core component to the Pareto credit infrastructure – a tokenized basket of curated credit lines – that functions as a DeFi-native credit index and synthetic dollar. Additional details about this exciting new offering will be rolled out soon, but it’s designed for broad market appeal, this yield-bearing asset provides investors with diversified, dollar-denominated exposure to carefully selected vaults. By prioritizing diversification, scalability, and composability, we’ve engineered this product to seamlessly integrate as a plug-and-play solution within the broader DeFi ecosystem, amplifying liquidity and market efficiency.

- PAR TGE Preparation

Preparations for the upcoming PAR token generation event are actively underway, strategically aligning it with the protocol’s growth trajectory and ensuring robust engagement from essential stakeholders. The TGE will serve as a cornerstone for coordinating incentives across borrowers, curators, and capital providers. Expect comprehensive details to follow soon, highlighting our approach to fostering a thriving, aligned community committed to the protocol’s long-term success.

Q2 2025 Budget

The expected budget for Q2-2025 is set at $240,860 in stablecoin, which includes the $32,360 carried over from the budget overrun in Q1.

The Pareto Treasury multisig currently holds approximately ~$20k in stablecoins and $19k in BTC/ETH/LRTs, based on current market prices. Should the temperature check for IDLE token holders yield a positive result, we plan to transfer $201,860 stablecoins or equivalent from the Fee Treasury.

Next Steps

As always, we appreciate the support from our community and partners. The team is heads-down building, and we’re just getting started. All Pareto/Idle DAO stakeholders and community are invited to weigh in on the proposal. This proposal will be followed by a Temperature Check vote with the published here, when ready.

If positive, the Q2-2025 mandate (budget and goals) will be officially approved.